A summary review of recent reports and papers on Peak Oil and Climate change

Peak Oil: A lost decade

In just the last six months, a growing number of reports and academic papers have discussed the theory of Peak Oil, “the point where further expansion of oil production becomes impossible, because new flows are fully offset by production declines or depletion.” ((Heads in the Sand: Governments Ignore the Oil Supply Crunch and Threaten the Climate Global Witness, October 2009, p. 30)) Warnings of Peak Oil have become increasingly common over the last decade, but never more so than after the oil price spike in July 2008. Here, I review three recent publications, reflecting the views of an academic research group, a UK industry group and a UK-based NGO in order to provide a summary of the current, and what may be the final, oil crisis. ((Heads in the Sand: Governments Ignore the Oil Supply Crunch and Threaten the Climate Global Witness, October 2009; The Oil Crunch – A wake-up call for the UK economy The Industry Taskforce on Peak Oil and Energy Security (ITPOES) – February 2010; The status of conventional world oil reserves—Hype or cause for concern? Nick A. Owen n, Oliver R. Inderwildi, David A. King – March 2010))

Owen, Inderwildi and King’s recent paper, The status of conventional world oil reserves—Hype or cause for concern?, supports previous studies by others which show that conventional oil production peaked in 2005 and that the peak production capacity of all liquids (excluding gas), will peak around 2010. Conventional oil supply is declining by over 4%/annum, with the shortfall and anticipated additional demand being met by non-conventional oil (deep sea, tar sands) and other liquid sources such as gas and bio-fuels. In just ten years, 50% of the global demand for liquid fuel will have to be met by sources that are not in production today. Not surprisingly then, speculation over the price of oil based on fundamental supply and demand factors, as well as global events such as the invasion of Iraq, Hurricane Katrina and Israel threatening to attack Iran, has resulted in increased volatility of prices, reaching a high of $147 a barrel in July 2008. In 2000, a barrel of oil cost around $20. A decade later, the price of oil is around $80 a barrel and the trend remains upwards.

Different economic theories applied to the supply and demand of oil offer opposite outcomes. One suggests that the law of diminishing returns would create an incentive to invest further in unconventional sources such as tar sands and deep sea resources. On the other hand, some economists argue that due to the inextricable link between oil and economic activity, high oil prices can’t be sustained and that a price of $100 a barrel would induce global recession, driving down oil prices and paradoxically reducing investment in alternative fuels. While rising oil prices can damage economic growth, lowering oil prices does not have the same, proportionate effect on stimulating growth. It has been estimated that oil price-GDP elasticity is -0.055 (+/- 0.005) meaning that a 10% rise in oil prices leads to a 0.55% loss in global GDP.

Owen, Inderwildi and King’s paper concludes that published world oil reserve estimates are inaccurate and should be revised downwards by a third. Over-reporting since the 1980s due to the ‘fight for quotas’ whereby OPEC agreed to set export quotas in proportion to reserve volumes, and the inclusion of tar-sands into reserve estimates since 2004 have distorted reality. They add that “supply and demand is likely to diverge between 2010 and 2015, unless demand falls in parallel with supply constrained induced recession” and that “the capacity to meet liquid fuel demand is contingent upon the rapid and immediate diversification of the liquid fuel mix, the transition to alternative energy carriers where appropriate, and demand side measures such as behavioural change and adaptation.”

In their report, The Oil Crunch. A wake-up call for the UK economy, the Industry Taskforce on Peak Oil and Energy Security (ITPOES) likens the effect of an imminent ‘oil crunch’ due mid-decade, with the current ‘credit crunch’. The report identifies a slow down in the production of oil prior to 2013, when it then begins to drop and without replacement infrastructure already in place, little can be done to address this fully within the next five years. The authors note that the discovery rate of oil is inadequate to meet projected demand and they too, have concerns over published OPEC quotas.

It is worth noting the difference between conventional and unconventional oil, such as deep sea oil and tar sands. The ITPOES report note how the unconventional sources of oil are much more energy intensive to exploit and therefore more expensive to supply oil from. Whereas OPEC might extract a barrel of oil for around $20, deep sea oil might cost around $70 and a barrel of oil from tar sands costs around $90 to extract. Therefore, as conventional sources decline at more than 4% per year for conventional sources, the replacement non-conventional oil pushes the price upwards if demand is to be met.

Global oil demand is forecast to rise, although much of this increased demand will come from developing countries. An extrapolation of historical demand would suggest that 120Mb/day will be required by 2050, compared to our current use of around 84.5Mb/day. However, a historical extrapolation of largely OECD demand could be deceptive, given that five out of a global population of six billion people live in non-OECD countries like China and India, where demand for oil is growing strongest. OECD demand for oil has flattened out in recent years and may stay that way, yet globalisation has created new markets which are emerging in an environment of relatively high oil prices and may be more immune to price rises than OECD economies. Where OECD countries may tip into recession when oil hits $100/barrel, China’s economy and therefore demand for oil, may continue to grow.

However, it is one thing to extrapolate continued economic growth and a corresponding demand for oil and another to supply that demand. Like Owen, Inderwildi and King, the ITPOES report argues that global oil capacity will peak later this year at around 91-92Mb/d and continue at that level until 2015 at which time depletion will overtake capacity growth. Just as the production of conventional oil has plateaued since 2005, the production of all liquids will plateau from 2010/11 for about five years before entering terminal decline. This would have happened two years earlier were it not for the global recession temporarily reducing demand.

Similarly, the ITPOES report highlights the link between high oil prices and recessions, drawing on recent work that shows how every US recession since 1960 has been preceded by rapid oil price rises and that when the price of oil exceeds 4% of US GNP, a recession occurs shortly afterwards. Although this correlation is not necessarily causation, it is “highly suggestive” and the report notes that 4% at current GNP is around $80/barrel, roughly the price of oil at the time of writing. OPEC have publicly stated that they prefer a price around $75/barrel.

The relationship between oil prices and the economy is referred to repeatedly in the ITPOES report. OECD countries are heading some way towards a partial decoupling of economic growth from the consumption of oil, although not to an extent that assures overall energy security. By 2013, OECD and non-OECD countries are likely to each take half of the total global supply of oil. The recession since 2008 has had some impact on global oil consumption, but this is recovering quickly and demand is on the rise. By 2014, prices are expected to be volatile, between $120-$150/barrel resulting in “recessionary forces” which produce a repeat of the 2008 recession. Consequently, oil prices are then expected to drop to somewhere between $90-$120/barrel, picking up again as the global economy recovers. And so on…

For the UK, the ITPOES report highlights the vulnerability of the transport sector and the knock-on effects that higher petrol prices are likely to have on our ‘just-in-time’ business models, recalling the effects of the fuel protests in 2000. While the domestic, industrial and service sectors of the UK economy are able to reduce their reliance on oil products, the transport sector continues to use more, with road and air transport using more than 50% of total UK consumption in 2008.

Increases in the cost of oil are felt in other sectors due to the vulnerability of the transport sector. It raises the cost of capital and puts off investment. With transportation being integral to the supply chain, the price rise is felt through higher consumables, significantly, food. The agriculture sector is highly dependent on oil for transportation fuel and as a component in fertilisers and insecticides. Due to increasing overall energy prices, the number of households trapped in fuel poverty is expected to continue to rise. Their business-as-usual scenario is expected to see the UK become an overwhelmingly major energy importer, with a devalued currency that offsets economic growth.

A more explicitly critical report has been written by the NGO, Global Witness. Focusing on the ‘four fundamentals’ of oil field depletion, declining discovery rates, insufficient new projects and increasing demand, Heads in the Sand specifically targets governments and their agencies for inaction, being “asleep at the wheel” and demonstrating a lack of appreciation of the imminence and scale of the problem a global oil crunch will bring. The report is especially critical of the International Energy Agency (IEA), upon which governments rely for the reporting of data and forecasts.

Heads in the Sand highlights the geopolitical and social consequences of peak oil, linking the energy crisis to the climate crisis in terms of how short-term, national economic interests are overtaking the need to shift to more sustainable energy supply systems. The consequences of this are disastrous affecting almost every aspect of life, including “food security, increased geopolitical tension, increased corruption and threats to the nascent global governance reform agenda, and the potential for major international conflict over resources.” As with the effects of climate change, the poor are vulnerable to oil price volatility and restricted supply, as was seen with the food price rises in 2008, which the World Food Programme described as a “…a silent tsunami threatening to plunge more than 100 million people on every continent into hunger.” Such volatility has geopolitical implications that are difficult to predict but are likely to be in the form of increased tension between states, rioting and protests around the world and human rights abuses perpetrated by kleptocratic governments. A scenario of collapse within one or two decades, with the decline of globalisation and increased environmental destruction, is suggested.

Like the other reports summarised above, Global Witness describe the strong links between oil use and economic growth and the consequent reversal of growth with a declining supply of oil. With each price shock comes “a vast deployment of national wealth by consuming economies, expenditure that would have been better used in the creation of an alternative and sustainable energy system.” The Heads in the Sand report provides a useful overview of key illustrated facts and figures relating to peak oil aimed at the general reader and is international in outlook, rather than concerned specifically with industry analysis or the impact on the UK economy. It also examines the alternatives to conventional oil production and their feasibility. Enhanced Oil Recovery (EOR), exploitation of Canada’s tar sands, oil shales, heavy oil and natural gas liquids all come with caveats that make them very unlikely to mitigate a decline in global oil production this decade and often come with serious environmental impacts.

In particular, is the problem of shrinking Energy Return On Investment (EROI), which refers to the ratio of energy input required to produce each unit of energy output. The Canadian tar sands, for example, have a net energy of around 10:1 compared with conventional oil of around 30:1. Therefore, the estimated production of 5.9m barrels/day from the tar sands by 2030 is actually worth just 1.6m barrels/day of conventional oil output. Increasingly, more energy that is produced is being diverted back into the production of raw energy.

Finally, Global Witness discuss the wasted decade when governments could have acted to mitigate the effects of peak oil, but chose to rely on the overly optimistic projections, claiming that the IEA misrepresented projected discovery data and was overconfident in its forecasts of future oil production. Clearly business as usual is no longer an option and radical measures are required by governments to address the scale and imminence of peak oil and its impacts.

Climate Change: Playing our part

Since the introduction of the Climate Change Act 2008, all UK residents are legally bound to this ‘enormous task’ which is set out in the government’s Low Carbon Transition Plan. I’ve chosen three sources ((Roger A Pielke Jr, The British Climate Change Act: a critical evaluation and proposed alternative approach, June 2009; The Royal Academy of Engineering, Generating the Future. A report on UK energy systems fit for 2050, March 2010; Makiko Sato & James Hansen, What Path is the Real World Following?)) that discuss the challenge of an 80% reduction of UK greenhouse gas emissions from 1990 levels by 2050 as well as an update on current emissions trends. One paper is concerned with policy, one with technology and another looks at ‘what path the real world is following?’ based on very recent data.

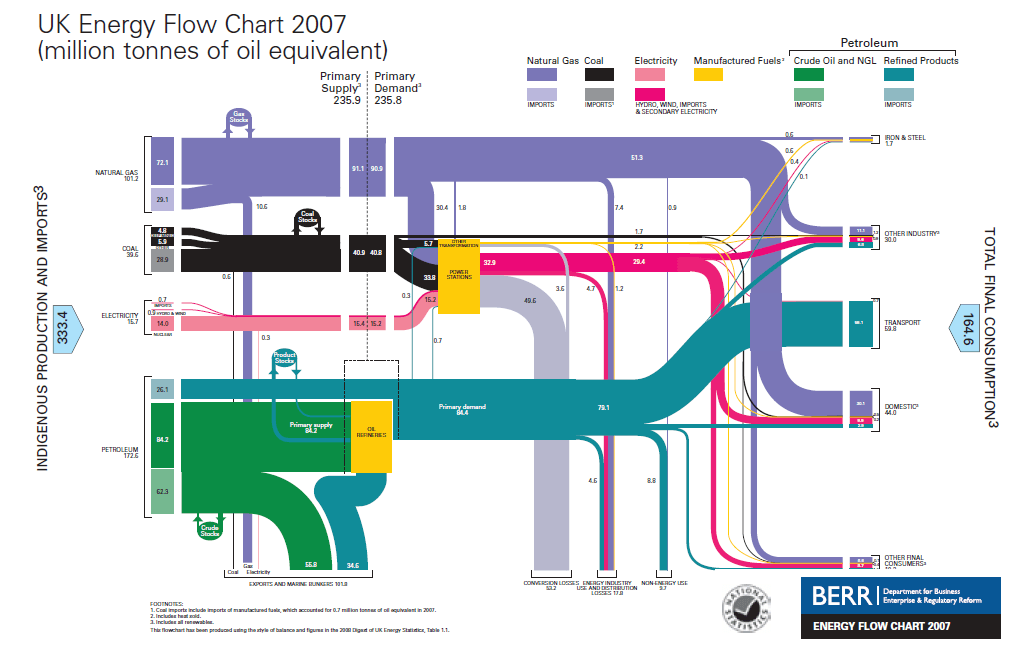

The Royal Academy of Engineering’s report, Generating the Future. A report on UK energy systems fit for 2050, warns of the magnitude of the task of reducing emissions by 80%, examining four possible energy scenarios that could meet that target. The report discusses the engineering challenges, emphasising how dependent we currently are on fossil fuels for the vast majority of our energy. A reduction in emissions of 80% would change the chart below, “beyond all recognition.” Carbon Capture and Storage (CCS) of coal, “if successful”, would allow for greater use of coal, but “major changes” would still be required.

The report makes the point that most of the technologies required are already available, but the period of transition from R&D to 90% market penetration is normally in the region of 30-40 years. Not only is the transition to the use of new technologies a major challenge, but the building of new infrastructure is also a “huge challenge.” Reference is made to how the country has met comparable challenges when “on a war footing” when a whole national manufacturing base shifts focus, but clearly the point being made is that the task is not just technological, nor economic, but political and social. Where is the policy that confronts the threat of this ‘war’?

At present there is generally insufficient incentive to make the switch to a new low-carbon technology, particularly when such a switch would be costly and disruptive.

As Engineers, the report highlights the scale of work that is required, listing examples such as the building of three miles of wave power machines each month for the next 40 years, the importing of huge numbers of wind and wave turbines, the building of port facilities to handle the scale of off-shore wind turbine construction (similar on scale to that required for the North Sea oil and gas development), a network of pipes to carry carbon captured from coal stations, again equivalent to the infrastructure developed for the North Sea Oil and gas industry. Their scenarios all necessitate a major upgrade to the electricity grid, not seen since the 1970s, requiring billions of pounds of investment, too. The electrification of transport and improvements to the efficiency of buildings, require “major systemic changes” to millions of individual assets. To build and maintain this, major training programmes are required to develop the skills needed for this to succeed. With new technologies, new academic disciplines will be needed, too. All of this will take place within an increasingly competitive global environment as other countries work towards decarbonisation and requires our industry to remain agile enough so as to avoid lock-in to new technologies that have short-term benefit but become obsolete over these crucial decades. “In summary, the changes to the UK energy system required to meet any of the scenarios will be considerable and disruptive.”

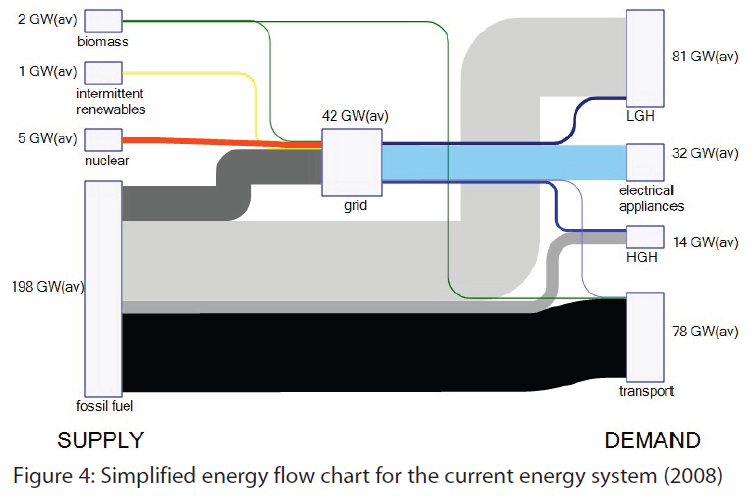

The report is largely concerned with the balance of energy and its flow and does not address issues of energy security. It shows how the Climate Change Act requires a change from this:

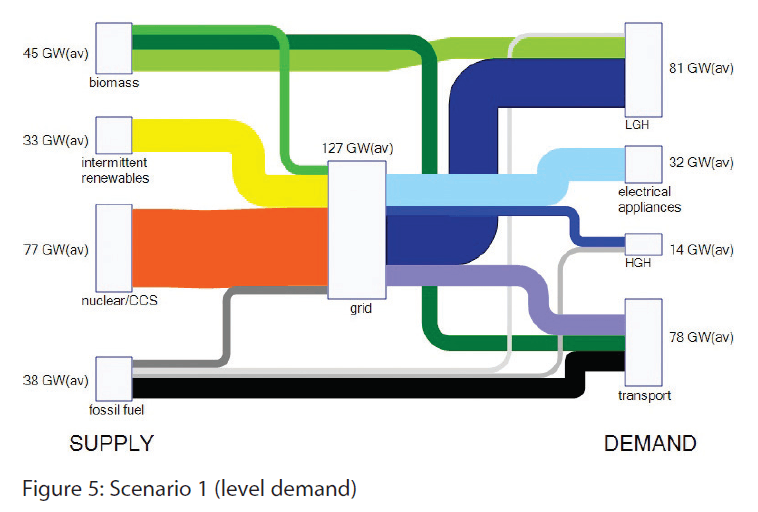

to this:

The first scenario sets the demand level to be the same as current levels. It should, however, be stressed that this by no means represents business as usual. Simply keeping demand at a similar level to now will require considerable effort. … In technological terms there are no choices to be made – the demand is so large that every available technology will be needed as quickly as possible. The main problems for scenario 1 will be buildability and cost to the nation. With over 80 new nuclear or CCS power plants required – around two per year – along with vast increases in all forms of renewables, building the system would require an enormous effort, probably only achievable by monopolising most of the national wealth and resources.

Rather than outlining the other three scenarios, which assume reductions and changes in demand through efficiencies and alternative uses of technology as well as a substantial use of low-grade heat, it is worth noting the statement above that keeping demand as it is, is a challenge in itself. Since 1980, with the exception of industry, ((Energy demand from industry has decreased -34% presumably due to the de-industrialisation of our economy)) the UK’s final energy demand has risen +68% for transport, +10% for the domestic sector and +3% for the service sector. ((DECC, UK Energy in Brief 2008)) There is a limit to how much more we can de-industrialise so the kinds of demand reductions required for scenarios 2, 3 & 4, assume reductions in sectors that have never previously shown reductions. All scenarios suffer from increased reliance on intermittent sources of energy supply and it is suggested that until we have “adjusted” to this new system, fossil fuels are used as backup sources until 2050. There is an assumption that new, unknown technologies will improve the resilience of supply beyond 2050.

The report concludes that while each of the four scenarios is only meant to be illustrative and not predictive, they do show there is no single ‘silver bullet’ that will achieve the cuts in emissions that are required. The report is useful in the way it discusses energy flows in a national system of supply and demand. Key to each scenario is that electricity generated from a variety of renewable and low carbon sources, will have to become the major source of power, providing energy to around 80% of our transportation. Energy demand must be reduced in all scenarios, even the first scenario which assumes no further increase in demand, represents a reduction on current forecasts. The need for behavioural change is briefly mentioned, but not elaborated on.

The urgency of the task is highlighted in terms of both its scale and the time required to meet the 2050 target and because a re-engineering of the UK’s energy infrastructure is necessarily measured in decades, with technologies themselves expected to be in place for several decades, too, it is the current crop of low carbon technologies that will have to make the significant contribution to the 2050 targets. Future technologies belong to the future and will make little contribution to the work required over the next 40 years. Quite bluntly, the report states: “There is no more time left for further consultations or detailed optimisation. Equally, there is no time left to wait for new technical developments or innovation. We have to commit to new plant and supporting infrastructure now.” The report calls for strong direction from government, admitting that the scale of the challenge is

currently beyond the capacity of the energy industry to deliver. In order to achieve the scale of change needed, industry will require strong direction from government. Current market forces and fiscal incentives will not be adequate to deliver the shareholder value in the short-term and to guarantee the scale of investment necessary in this timescale.

Finally, the report is critical of the current policy situation, stating that

current government structures, including market regulation, are, as yet, simply not adequate for the task.” Government must be re-organised around the challenge (i.e. be on a ‘war footing’), in order to provide “the clear and stable long-term framework for business and the public that is not currently in evidence. It also needs to be recognised that the significant changes required to the UK energy system to meet the emissions reduction targets will inevitably, involve significant rises in energy costs to end users. ((I should also add that a similar report by the Institute of Mechanical Engineers complements the recommendations of this report, too. However, the report places a greater emphasis on the need for methods of adaptation and not just mitigation.))

Pielke Jnr.’s paper, The British Climate Change Act: a critical evaluation and proposed alternative approach, is a short and revealing paper which argues that the magnitude of the task set out by the UK Climate Change Act will inevitably lead to its failure as a piece of legislation and that the sooner this is recognised, the better chance there is of creating policy which drives realistic outcomes. The paper is not an examination of technologies, but rather a calculation of and reflection on the UK’s past rates of decarbonisation and a comparison with other countries’ demonstrable rates of decarbonisation.

Methodologically, Pielke Jnr. examines two “primary factors” that lead to emissions: economic growth (or contraction) i.e. GDP, and changes in technology, typically represented as carbon dioxide emissions per unit of GDP.

Each of these two primary factors is typically broken down into a further two sub-factors. GDP growth (or contraction) is comprised of changes in population and in per capita GDP. Carbon dioxide emissions per unit GDP is represented by the product of energy intensity, which refers to energy per unit of GDP and carbon intensity, which refers to the amount of carbon per unit of energy.

The logic of these relationships means that “carbon accumulating in the atmosphere can be reduced only by reducing (a) population, (b) per capita GDP, or (c) carbon intensity of the economy.” Pielke is concerned with the creation of policy that will achieve its intended effect and notes that population reduction and/or a reduction in per capita GDP are not realistic strategies for governments to promote policy. Therefore, a reduction in the carbon intensity of the economy (decarbonisation), is the only realistic policy choice.

The paper approaches the challenge of de-carbonisation in two ways: a ‘bottom up’ approach, which looks at the projected increase in UK population as well as projections of per capita GDP, from which an implied rate of decarbonisation can be estimated. The other, ‘top-down’ approach, examines overall GDP growth and derives the implied rates of decarbonisation needed to meet the specified target. Through a series of straightforward calculations, Pielke’s bottom-up analysis shows that

the combined effects of population and per capita economic growth imply that to meet the 2022 and 2050 emissions targets increasing energy efficiency and reduced carbon intensity of energy would have to occur at an average annual rate of 5.4%–2050 and 4.0%– 2022. These numbers also imply that successfully meeting the 2022 target with a 4.0% annual rate of decarbonization would necessitate a rate higher than 5.4% from 2022 to 2050.

The top-down analysis begins with an assumption about future economic growth, integrating future population growth and future per capita economic growth, then works backwards to determine the rate of de-carbonisation required to meet the future emissions target. This approach underlines the fact that higher rates of GDP growth likewise require higher rates of decarbonisation. It is worth reading the paper for a full understanding of the figures alone, but in summary, this analysis shows that the rates of de-carbonisation required are “4.4% per year for the 2022 target and 5.5% for the 2050 target. These numbers are substantially higher than the rates of decarbonization observed from 1980 to 2006 and 2001 to 2006.” By comparison, between 1980 and 2006, the actual rate of de-carbonisation in the UK was 1.9%, decreasing to 1.3% during the period 2001-6.

In response to this, Julia King, Vice Chancellor of Aston University and member of the Climate Change Committee, replied that technically, these rates of de-carbonisation are “do-able”. However,

I think you really do need to take due account of the fact that most people who are putting together targets and timetables are doing this on the basis of a lot of research into potential scenarios. It is another issue turning that into policy, for governments, and it is very easy for all of us who do not have to be elected to say ‘this is how I would do it’, and I have a lot of sympathy for our politicians, because they are dealing with extremely selfish populations.

The latter part of Pielke’s paper compares his analysis with the actual rates of decarbonisation in the UK and other countries. France provides a good example of the magnitude of the decarbonisation challenge as it is the major, developed economy with the lowest rates of emissions (0.30 t of carbon dioxide per $1000 of GDP in 2006). France has achieved this due to its reliance on nuclear power for electricity generation and was able to decarbonise overall by about 2.5% during the period 1980-2006. Notably, however, it only achieved a rate of 1.0% during 1990 to 2006.

It took France about 20 years to decarbonize from 0.42 t of carbon dioxide per $1000 GDP, the level of the UK in 2006, to 0.30 t of carbon dioxide per $1000 GDP. France’s decarbonization experience thus provides a useful analogue. For the UK to be on pace to achieve the targets for emissions reductions implied by the Climate Change Act its economy would have to become as carbon efficient as France by no later than 2016 … In practical terms this could be achieved, for example, with about 30 new nuclear plants to be built and in operation by 2015, displacing coal and gas fired electrical generation.

Pielke concludes by arguing that the approach to the Climate Change Act has been backwards, setting a target without being clear on how it will be achieved. In terms of policy success, he also points out the danger of confusing a reduction in emissions with decarbonisation, stating that a lowering of emissions, due to the recession for example, does little to change the role of energy technology in the economy. Without changes in energy technology, emissions remain tightly coupled with GDP and population growth, areas which the Climate Change Act is not attempting to reduce. The success of this policy will be on reducing emissions under the forecast conditions of economic and population growth. Thus, carbon dioxide emissions per unit of GDP (i.e. decarbonisation) is the key measurement by which to judge the policy. The UK has achieved significant rates of decarbonisation in the past (better than other countries but not as high as the Act implies), but, as pointed out above, this was due to the de-industrialisation of the 1980s and 1990s, and this rate has since slowed considerably.

Given the magnitude of the challenge and the pace of action, it would not be too strong a conclusion to suggest that the Climate Change Act has failed even before it has gotten started. The Climate Change Act does have a provision for the relevant minister to amend the targets and timetable, but only for certain conditions. Failure to meet the targets is not among those conditions. It seems likely that the Climate Change Act will have to be revisited by Parliament or simply ignored by policy makers. Achievement of its targets does not appear to be a realistic option… Because no one knows how fast a large economy can decarbonize, any policy (or policies) focused on decarbonization will have to proceed incrementally, with constant adjustment based on the proven ability to accelerate decarbonization (cf Anderson et al 2008). Setting targets and timetables for emissions reductions absent knowledge of the ability to decarbonize is thus just political fiction.

Finally, Pielke proposes alternative methods of accelerating decarbonisation. These would involve international co-operation in assisting other countries to decarbonise to at least the level currently observed in the UK and focussing on sector specific policy that addressed the processes of decarbonisation but without the impossible targets and timetables, the expansion of low/no carbon energy supplies and incremental improvements rather than long-term measures. It is a useful paper, both for its analysis and its approach, one which clearly recognises that economic growth will remain the first priority for the UK and other countries.

The last recent source on Climate Change research I’d like to reflect on is Makiko Sato & James Hansen’s, What Path is the Real World Following? This is a website which provides updates to NASA scientist Hansen’s book, Storms of My Grandchildren.

What the graph above shows is that current global emissions are worse than any of the ‘marker scenarios’ outlined in the 2007 IPCC assessment report on Climate Change. Rather than repeat it here, Stuart Staniford provides an excellent analysis of what this implies. To add to this, I would simply suggest that by the time of the next IPCC report in 2014, it seems likely to me that if the Peak Oil and Climate Change summaries I’ve given above are on the money, the strategy, policy and methods of public engagement to address the related predicaments of both energy and climate change will require a significant re-think in the middle of this decade, just before the next UK general election.

Some significant questions remain, too:

If economic growth is coupled to the supply of energy, how will Peak Oil affect global GDP? The Climate Change Act, Peilke’s analysis and the IPCC scenarios, assume continued economic growth yet how will a decline in the production of oil (and by implication a decline in GDP) affect both the production and supply of other fossil fuels and our ability to fund the required transition to low-carbon economies? Will we have to wait until the subsequent (post 2014) IPCC report before they take Peak Oil and its economic consequences into account? I guess so.