In my previous post, I discussed energy efficiency and our carbon emissions. I tried to highlight how despite our apparent efficiencies, our absolute emissions have risen 19% since 1990. One of the reasons for this is known by Economists as the Jevons Paradox.

The Jevons Paradox (sometimes called the Jevons effect) is the proposition that technological progress that increases the efficiency with which a resource is used, tends to increase (rather than decrease) the rate of consumption of that resource… In addition to reducing the amount needed for a given use, improved efficiency lowers the relative cost of using a resource – which increases demand and speeds economic growth, further increasing demand. Overall resource use increases or decreases depending on which effect predominates… The Jevons Paradox only applies to technological improvements that increase fuel efficiency.

You will see from the Wikipedia article, that one method of controlling consumption of the resource is a tax to try to ensure that the price and therefore the demand for the resource, remains roughly the same. As I understand it, this is what the CRC Energy Efficiency Scheme is attempting to do. It will force universities to become more energy efficient in order to lower our emissions. Rather than then use those efficiencies to purchase more emissions producing resources, which is what we normally do, the fines and reputational incentive will force us to keep making year on year savings of carbon emissions.

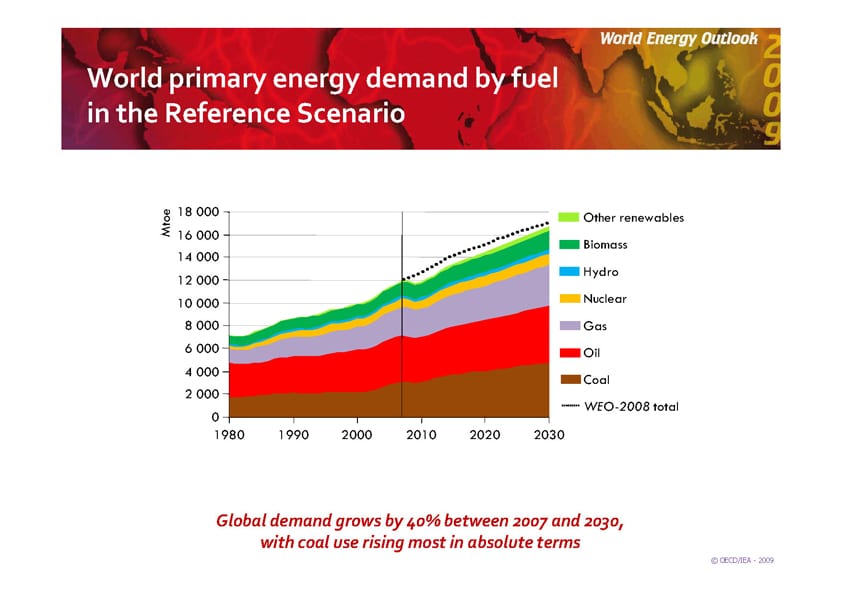

As the CRC Energy Efficiency Scheme highlights, the most effective way to reduce our emissions is to focus on our consumption of energy. Around 75% of worldwide C02 emissions caused by humans are due to the use of fossil fuels to make energy. ((See the IPCC 2007 Summary for Policy Makers, p.5 for a break down. Note that fossil fuels only account for 56% of total greenhouse gas emissions.)) Last week, the International Energy Agency published their annual World Energy Outlook, regarded as the most authoritative assessment of worldwide energy production and consumption. ((The authority of the IEA has been somewhat undermined by a whistleblower but nevertheless, it’s the most complete assessment available to us.)) The graph below shows their ‘reference scenario’, which is a snapshot of the current picture and, if we make no changes at all to our use of energy, where we are heading.

As you can see, coal, oil and gas make up the majority of the world’s sources of energy and without making changes, we are heading for an increase of 40% by 2030. Projected to 2050 and beyond, this results in around 1000ppm CO2 equivalent, more than double the safe target figure. ((How the Energy Sector Can Deliver on a Climate Agreement in Copenhagen, IEA, 2009, p.10))

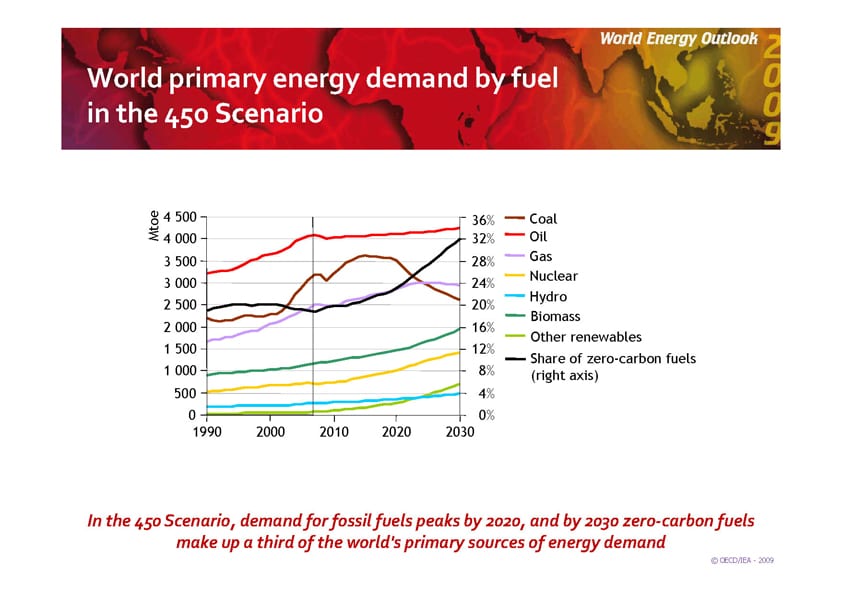

The IEA’s ‘450 Scenario’, which refers to the 450ppm of C02 equivalent emissions discussed previously, is a different picture.

In the 450 Scenario, energy related emissions peak in 2020, together with global demand for fossil fuels and our use of renewables climbs steadily. Forecasts like this are notably about what we should do, not what we will do. We might also consider what we can do.

David McKay, Cambridge Prof. of Physics and Chief Scientific Advisor to DECC, has written Without Hot Air, a well regarded book that can be downloaded for free. In it, he examines in detail, the supply and demand for energy in the UK. His conclusions offer five energy plans for Britain, All plans take into account energy efficiencies through the use of more efficient technologies. The five plans that he offers are technically achievable but as you read through them, I think you’ll find that they severely test your belief that they can be achieved. They all assume that our use of energy remains largely the same, driven by the objective of economic growth. MacKay recognises that the plans might sound absurd and invites readers to come up with something better, “but make sure it adds up!” Finally, he notes a plan might be to decrease power consumption per capita or reduce our population, neither of which are any easier to achieve. A further complication to all of this is that the IEA 450ppm scenario offers a global picture whereas MacKay’s book concentrates on a UK scenario. If the five plans he provides look absurd for the UK to achieve, it is reasonable to assume that a scenario where every other country addresses their energy infrastructure with similar plans, might be even more absurd.

Peak Oil

In an earlier post, I introduced Peak Oil and this is what I want to discuss for the rest of this post. It’s a simple idea to understand but has profound implications for the next few decades. In fact, the implications are much more difficult to grasp than the idea itself and, if correct, will certainly impact on the way Higher Education institutions operate and the nature of public education.

Previously, I introduced the idea of ‘resilient eduction’ and asked how it might be developed in the context of Higher Education.

…a pedagogy and curriculum that both encourages and fosters the radical change that is necessary as well as ensuring that the present depth, breadth and quality of education is sustainable in a future where there may be less abundance and freedom than we have become accustomed to.

Richard Hall at De Montfort University has recently responded to this in a long and thoughtful post. As part of our ‘blog conversation’, in which Warren Pearce and Nick Fraser are also contributing, I’d like to offer an overview of the story of oil and, in later posts, point to how the current provision of Higher Education can be seen as a product of an abundance of oil. On the flip side, in a future where oil becomes more scarce, our provision of education might have to change radically. An overall response to this future might collectively be to increase our ‘resilience’ to the impact of peak oil. ((I acknowledge, as Richard has discussed at length in his post, that we are both borrowing from and aligning with the Transition movement’s use of the term ‘resilience’ in the face of peak oil and climate change. In effect, we are contributing to the Transition movement’s work by specifically examining Higher Education in a period of transition.)) Here’s why:

This is Hubbert’s Curve. It was proposed by Hubbert in the 1950s and, with a reliable amount of accuracy, has so far predicted the global rate of oil production. The dotted line is the actual historic rate of production until 2004. What it tells us is that we produced (due to demand), more oil than the model predicted during the 1960s and 70s. The energy crisis of the late 1970s led to an adjustment (the dip) and since then the world has been following Hubbert’s curve very closely. The very end of the dotted line shows that production in 2004 exceeded Hubbert’s proposal and might lead us to think that with more recent data, we’re repeating the 1970s all over again. This is not the case as you’ll see a few charts down as production has plateaued since 2005. Before we look at that, it’s worth noting that the rate of oil discovery has been in decline since the 1960s. Discoveries have been made since 1964, only they have been smaller amounts of oil and do not add up to what was available to us fifty years ago.

Hubbert’s original work, while employed as a Geophysicist with Shell, predicted the peak of oil production for the USA and this provides a useful historical example that can be extrapolated globally.

As you can see, oil production in the 48 states of the USA peaked in 1970. As this became apparent, oil production in Alaska was increased to make up for the shortfall but capacity also began to decline in Alaska in the mid-1980s. When the production rate of oil began to decline in the USA, the production rate of oil in the UK and Mexico was increased but this also went into decline. The UK has been a net importer of oil since 2004.

The map below offers a global overview of countries where oil production has peaked (around two-thirds).

Critics of peak oil think that there is plenty of oil left, not only to be discovered but already discovered and not yet fully exploited. Their argument often points to the availability of oil in the tar sands of Canada and other so-called Megaprojects. There are many problems with this view, not least that the production techniques emit more carbon emissions than conventional oil production, but here it is worth noting that they too are subject to decline and make up a relatively small amount of the global requirement for oil.

The chart below, shows the November 2009 forecast. Click on the image to read what it means in detail, but the point to make here is that global oil production has plateaued since 2005, leading many analysts to believe that Hubbert’s Curve and other similar forecasts, were correct. In effect, we are at the top of the peak.

Moving from production rates to pricing, it is useful to note that as the production of oil has plateaued since 2005, the price of oil continued to rise until June 2008. The recession and consequent drop in demand for oil sent the price of oil down to $34/barrel in February and has rebounded to around $80/barrel in the last month.

What is especially interesting to me is that because oil is a primary energy source used in the extraction and transportation processes of other energy sources, the price of electricity, largely derived from coal and gas, follows the price of oil very closely. Therefore, we might reasonably assume that as the production of oil declines over the next 20 years, the price of electricity will rise.

It’s interesting to see that recessions follow oil price spikes quite reliably, as happened in 2008. One observation that has been made is that the USA doesn’t seem to be able to sustain economic growth when oil prices are consistently above $80 or so. James Hamilton, at the University of California, argues that oil prices tipped the US economy into recession.

Where will we get our energy from?

Like all fossil fuels, oil is a finite resource and there is no disagreement about the supply of oil eventually running out. The point however, is not about oil running out but rather when it becomes uneconomic as a source of energy. The IEA would agree with this as do the UK Energy Research Council, who last month, published the Global Depletion Report, which is an authoritative review of all available evidence to date. They conclude:

On the basis of current evidence we suggest that a peak of conventional oil production before 2030 appears likely and there is a significant risk of a peak before 2020.

If we accept that there will be a peak in the production of oil within ten years, if it hasn’t already occurred, we need to return to David MacKay’s Five Energy Plans for Britain, and consider the alternatives. There are two significant variables that need to be taken into account when considering a transition from oil to other energy sources. The first is how long it will take to replace our current oil-based global energy infrastructure with something we think is a viable alternative.

In a 2005 report for the US Department of Energy, ((The ‘Hirsch Report’: Peaking of World Oil Production: Impacts, Mitigation and Risk Management (PDF). )) Robert Hirsch stated:

The peaking of world oil production presents the U.S. and the world with an unprecedented risk management problem. As peaking is approached, liquid fuel prices and price volatility will increase dramatically, and, without timely mitigation, the economic, social, and political costs will be unprecedented. Viable mitigation options exist on both the supply and demand sides, but to have substantial impact, they must be initiated more than a decade in advance of peaking.

The second significant variable is the net energy that can be extracted from other sources of energy, such as nuclear, solar and wind. (We should also note that oil is not just a source of fuel, but a composite in plastics, fertiliser, medicines, rubber, asphalt and other useful products. As a replacement for oil in products other than fuel, nuclear, wind, solar, etc. are not viable. Anyway, here were are discussing primary sources of energy).

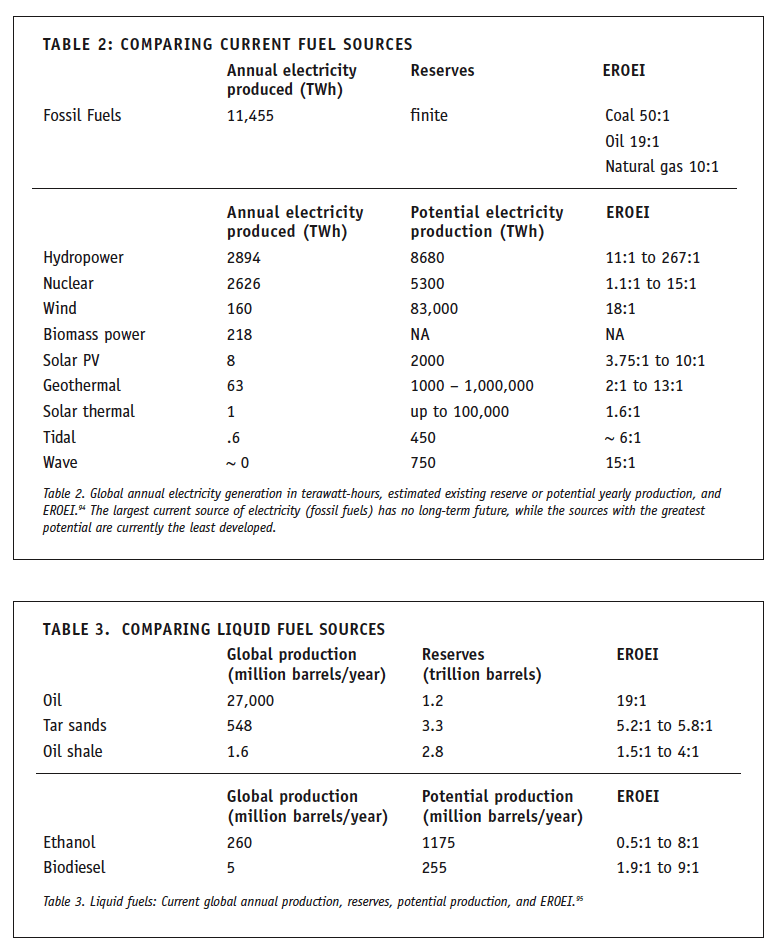

Below is a diagram by Charles Hall of SUNY, (click to enlarge), which offers a view of the Energy Return on Investment (EROI) of various sources of energy. It is difficult to be very precise when calculating net energy, or what energy is left over after energy is invested in producing energy, but this is the most thorough analysis available and offers a rough index.

It shows two significant things that need to be highlighted when considering the transition from fossil fuels to renewables. The first is that oil, coal and gas are more intensive forms of energy than other sources of raw energy. “A litre of oil packs 38MJ of chemical energy, as much energy as is expended by a person working two-weeks of 10-hour days.” ((Richard Heinberg, Searching for a Miracle, 2009, p. 32)) The second, is that the EROI of renewables, even nuclear, is less than that of oil, coal and gas. None are direct replacements for fossil fuels and, as David MacKay has shown, it is very difficult (‘absurd?’) to stack all viable renewables up together as a replacement for current UK consumption levels of energy. Remember, that no-one expects our consumption of energy to voluntarily decrease. Our emissions from fossil-fuels are expected to decrease, but somehow the expectation is that we will continue to use the same, if not more, amounts of energy as we do today.

The Post Carbon Institute recently published a report based on the work of Charles Hall, which offers a very readable introduction to EROI (they call it Energy Returned on Energy Invested (EROEI). A summary of the analysis of EROEI can be seen below.

The report concludes that substantial per-capita reductions in energy use is the only way we can look forward. “…the question the world faces is no longer whether to reduce energy consumption, but how.” ((Richard Heinberg, Searching for a Miracle, 2009, p. 65))

If this is the predicament we are in, how do we fruitfully manage the desire for economic growth, the time required to transition from a fossil-fuel-based infrastructure and the replacement of carbon-emitting oil, coal and gas with other forms of energy that provide a similar net value to our lives? The report offers several recommendations, including the need to move to a no-growth, steady-state economy, because as we have seen from the GDP chart above, energy and economic activity are closely tied.

It is true that improvements in efficiency, the introduction of new technologies, and the shifting of emphasis from basic production to provision of services can enable some economic growth to occur in specific sectors without an increase in energy consumption. But such trends have inherent bounds. Over the long run, static or falling energy supplies must be reflected in economic stasis or contraction. ((ibid, p. 67))

It is pointless me re-iterating the full conclusion of the report, but I should note that there are other reports that offer similar conclusions. ((For example, see Prosperity Without Growth – The Transition to a Sustainable Economy from the Sustainable Development Commission, ‘The Government’s independent watchdog on sustainable development’ & Nine Meals from Anarchy from the New Economics Foundation))

A Resilient Education

Richard mentions the Resilient Nation pamphlet from Demos. In it, the author recognises how education already plays a part in teaching people how to be resilient in the face of threats such as fire and first-aid, but highlights the need for society to become more resilient to other threats such as natural disaster and the impact of energy shortages. Documents like this provide a useful contribution for us to begin to think about resilience and how it affects both the operation of our institutions and the development of a more relevant curriculum in a world facing impacts from climate change, peak oil and zero-growth or even a ‘planned recession‘. We need to consider our use of and the benefits of technology both as a way of running resilient institutions and as effective tools for teaching about resilience. For example, is the promotion of cloud computing and ubiquitous internet access increasing our resilience or not?

The Transition Town movement is increasingly being seen as a way to think and learn about ‘resilience’. The reports mentioned from NEF, PCI and SDC all refer positively to the Transition Town movement. It borrows the term from the ecological sciences, so there is a history of the term ‘resilience’ which educators can draw on when considering how it might be usefully employed both operationally, in terms of institutional continuity (whatever form that takes), and in the delivery of a relevant curriculum which produces graduates who are both prepared for the future impacts of climate change and peak oil and eager to work to address the challenges. There are a growing number of Transition groups meeting across the country and people working in universities, like myself, are members attempting to work with local government to create more resilient communities.

The purpose of this post, however, was to provide an overview of energy and oil as a reference for moving on to think more about a ‘resilient education’. My interests are in the institutional and organisational effects this might have, particularly relating to our dependence on technology to operate Higher Education Institutions and deliver teaching and research. Another important area to consider is how to develop resilient citizens, as Richard has begun to do. Since its discovery, oil has changed the way we live. It has changed the fabric of society, the institutions we have created, our expectations of the future and our ambitions for ourselves. As the availability of oil changes, so will our institutions and our communities. My interest is the impact to and role of education within this environment of change. My specific interest is the role and value of technology (in whatever forms) to teach and learn in this environment of change.

Here’s an interesting contribution to the discussion of the future of HE from a slightly different angle: Would you want your son/daughter to be a plumber?

http://www.guardian.co.uk/theguardian/2009/dec/05/ian-jack-britain-lacks-skilled-labour

It’s about resilience, and makes the important point that the West may need more skilled manual workers in future to repair stuff when we can’t afford to produce new ones (because of the price of oil, for example). While I’d like to think that Universities don’t necessarily produce “office drones”, as the article seems to imply, the point about what our society values is a good one.

A very comprehensive post – thank you.

I’m quite annoyed that despite carbon emissions problems and decline in fossil fuel resources the growth in those areas surpassed the growth even in nuclear, also not ideal.

David’s link is also interesting – even now brick layers are earning more than office managers. In third world countries where resources are already far too limited, the “bush mechanics” approach to keeping things working is already prevalent.

I have worked in green energy and the barrier which came up all too often was the cost of greener living, and look at the furore which happened when ‘normal’ lightbulbs were banned on favour of energy saving ones?

The world need to wake up, and wake up soon.

I have to agree with Vince there. Although I do prefer energy saving bulbs now. 🙂

Stacey, the problem with energy saving lightbulbs is there collosal usage of mercury which in the end is more polluting than traditional light bulbs. There doesn’t seem to be any eco-friendly alternative yet.